Operational and Capital Performance in Q4 2024

Devon Energy (DVN) ended 2024 with record-breaking operational performance, surpassing production estimates across multiple basins. Total production reached 848Mboepd, marking a QoQ 16% increase, largely driven by the Eagle Ford and Bakken care of the Grayson Mill acquisition.

Drilling and Completion (D&C), and Capex Activity

DVN averaged 24 drilling rigs and 6 completion crews across its assets. 128 gross operated wells were brought online in Q4, with an average lateral length of 9,900 feet. The company achieved 15% efficiency improvements in both drilling footage per day and completed footage per day, reducing costs and optimizing well productivity. This D&C activity equated to $872MM in upstream capital, 3% below prior quarter guidance. Non-D&C Capex of $54MM was allocated to midstream, carbon capture, and corporate spending. Lastly, DVN spent $116MM on leasehold acquisitions, expanding its footprint in the Delaware, Williston, and Anadarko basins.

2025 Capital Budget and Production Guidance

For 2025, DVN has outlined a capital program ranging between $3.8B and $4.0B, reflecting a $200MM decrease from prior estimates. The budget is concentrated on the Delaware basin with 50%+ of Capex allocated to this basin, while continuing its strategy of multi-zone development and enhanced operational efficiency. Total production is projected to range between 805 - 825Mboepd. Oil production is expected to range between 380-386Mbpd. Gas production guidance is 1,320–1,365MMcfpd.

Basin Allocation for 2025

Delaware Basin: DVN will allocate more than 50% of its total Capex, with 14 rigs and 3 completion crews planned for ~260 gross wells drilled and TIL’ed. This basin remains DVN’s highest-return asset, leveraging its multi-zone development strategy to enhance returns while extending inventory life.

Rockies (Williston & Powder River Basins): DVN intends to focus capital on the western portion of the Williston Basin, integrating synergies from its recent acquisition. The company expects $50MM in identified capital savings, largely through self-sourcing materials, drilling efficiencies, and simul-frac completion strategies. Forecasting ~5 rigs between the two basins, with ~75% of the $1B capital budget allocated towards the Williston basin.

Eagle Ford: The company dissolved its joint venture with BPX Production Company (BPX), allowing DVN to operate 46,000 net acres with 95% working interest. The company expects to reduce drilling and completion costs by $2MM per well in DeWitt County due to optimized well designs and supply chain advantages. Forecasting ~2 rigs, ranging from 1-3 rigs during the course of the year.

Anadarko Basin: The Dow JV extension provides 49 additional drilling locations with a $40MM drilling carry. Development will begin in Q2 2025, providing additional gas-weighted production upside. Forecasting 2-3 rigs accounting for 25 wells drilled and 28 wells completed, equating to ~$200MM in Capex for FY25.

Key Initiatives for 2025

DVN’s 2025 plan centers around capital efficiency, production discipline, and shareholder returns. The company remains focused on expanding operational efficiencies while returning capital to shareholders through dividends and share repurchases.

Drilling Efficiency Gains: DVN improved drilling efficiency by 15% in 2024, and expects continued gains in completed wells per crew per month.

Cost Reductions: The company expects total drilling and completion costs per well to decrease across all core basins due to multi-zone well designs, simul-frac strategies, and supply chain optimizations.

Operational Improvements in the Rockies: DVN aims to stabilize production in the Bakken while maximizing synergies from the Grayson Mill acquisition.

Gas Portfolio Optimization: With upward momentum in natural gas pricing, DVN’s gas marketing team has secured premium pricing exposure, particularly in Gulf Coast LNG and Southeast U.S. power markets.

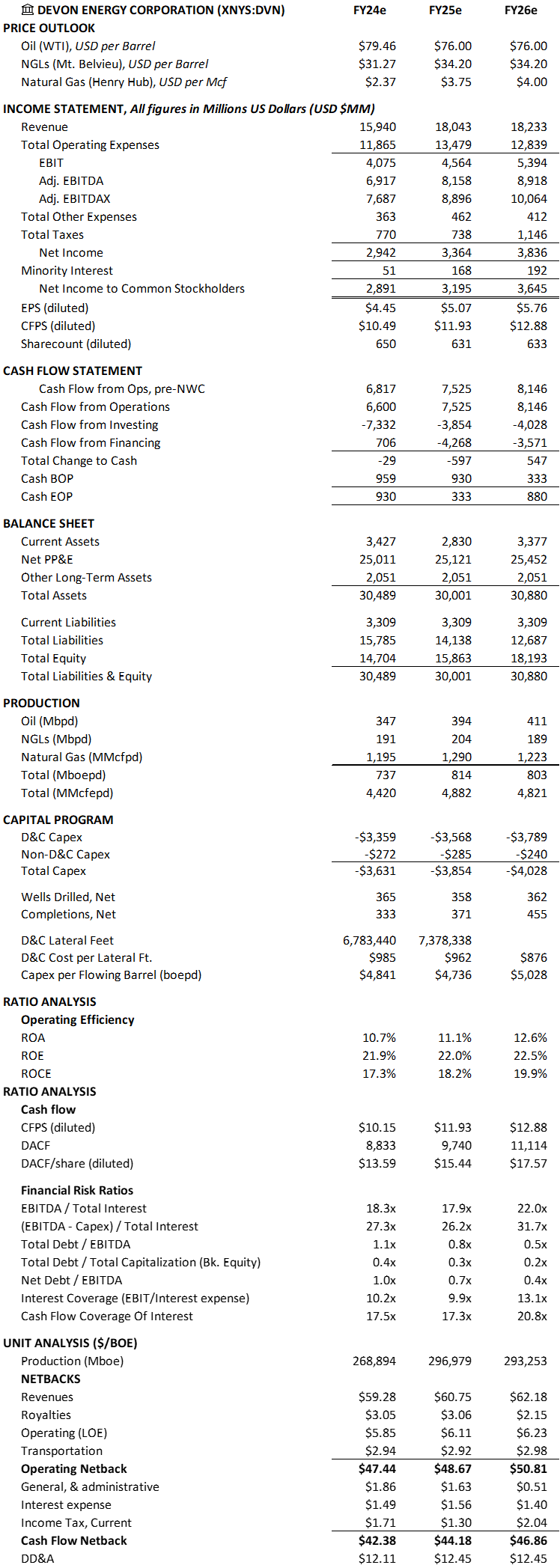

Financial Model Forecast

Companies Mentioned

Devon Energy Corporation (DVN)

BPX Production Company (BPX)

Disclaimer: All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time of publishing. However, in view of the natural scope for human and/or mechanical error, either at source or during production, Patrick Enwright accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of the publication. All information is provided without warranty, and Patrick Enwright makes no representation of warranty of any kind as to the accuracy or completeness of any information hereto contained.