Maybe it’s the Stephen King reference, but when I reviewed Eric Nuttall’s Twitter take on US E&Ps entering the "dead zone" with WTI crude at $60/bbl (twitter), I couldn’t help but put on my Johnny Smith hat and take a shot at seeing into the future. I refreshed my models for Diamondback Energy (FANG), Permian Resources (PR), and Matador Resources (MTDR), incorporating 1Q25 average rig results, FANG’s preliminary 1Q25 operational update ahead of its May 6th earnings call (link), and ran the breakeven scenarios to get a better sense of the landscape in 2025 and 2026.

The core premise: what does free cash flow breakeven look like for prominent Permian producers in a $65/bbl WTI world, particularly when you overlay realistic gas price assumptions?

Baseline Analysis - Breakeven Oil Price at Forecasted Gas Pricing

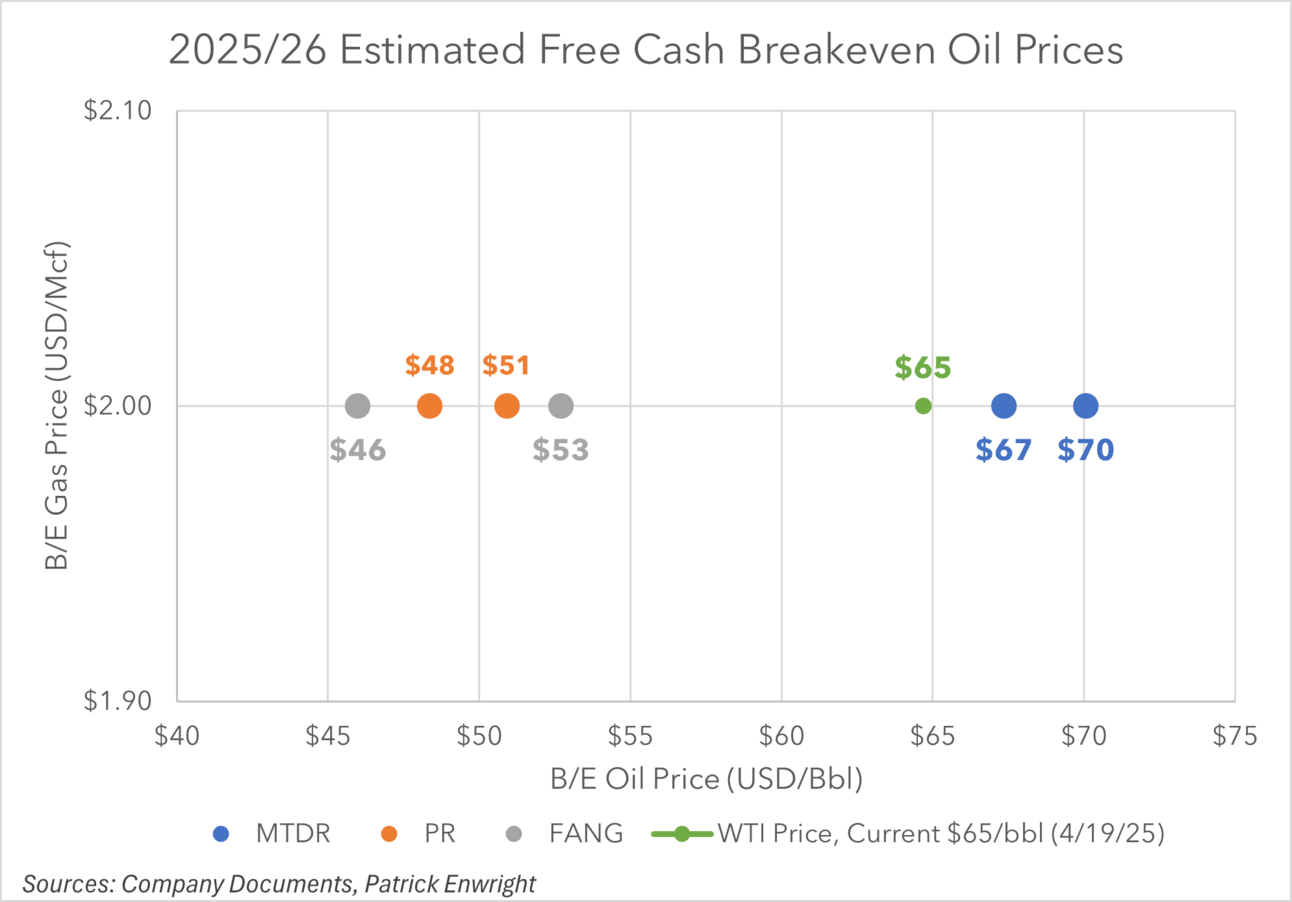

My gas price assumptions incorporate corporate guidance as well as historical price differential trends, which reflect current strip prices for each E&P. By accounting for these regional differentials and takeaway limitations the differences in scale and asset quality becomes clear. As shown in the first chart above, FANG and PR sit comfortably below the current WTI spot price of $65/bbl (as of 4/19/25). FANG’s estimated breakeven is $46–$52/bbl for this year and next, depending on assumptions around Capex and gas realizations. PR is modestly higher, at $52-$54/bbl, though representative of a lean, cost-driven producer.

MTDR, however, lands on the other side of that threshold. With estimated breakeven oil prices at $61-$65/bbl, it’s skating dangerously close to negative free cash flow territory. And that’s incorporating a ~$3.25+/mcf gas environment given MTDR’s midstream capabilities and their ability to realize advantageous gas prices amid the Delaware basin’s lack of takeaway capacity.

This analysis brings me back to the importance of scale. FANG is now producing ~880 Mboepd, PR is at ~380 Mboepd, and MTDR sits at ~205 Mboepd. In a commodity environment that looks increasingly range-bound or even bearish, these extra barrels matter. Scale brings cost efficiencies, bargaining power on offtake agreements, and better leverage on D&C oilfield services pricing. You can see that efficiency gap manifest directly in the $10+/bbl spread in breakeven prices among the larger E&Ps.

Sensitivity Analysis – Isolating Oil Exposure

To isolate the oil breakeven impact, I also ran a flat $2/mcf gas sensitivity across all three producers. While I view this approach as more illustrative than practical—each operator has different asset exposure and gas monetization strategies—it still helps to highlight the structural differences in operating activities.

Here’s where MTDR’s integrated midstream story starts to matter. The company’s ownership in San Mateo gives it a cushioned differential on realized gas pricing. In 4Q24, MTDR reported a $2.75/mcf gas realization—well above regional benchmarks. Adjusting for this uplift, MTDR’s breakeven oil price increases to ~$67/bbl, and above current WTI prices. Without midstream ownership, it would be well underwater.

By contrast, FANG’s breakeven stays below $50/bbl in nearly every scenario. This is largely thanks to the successful acquisition and integration of Endeavor (2023) and Double Eagle (closed April 1, 2025), which have shifted more of the company’s production into core Midland acreage with lower per-barrel costs and higher oil cuts. FANG’s capital discipline, portfolio rationalization, and scale are starting to show up in the numbers.

PR is similarly benefiting from M&A scale—particularly from its 2023 acquisition of Earthstone and the 2024 bolt-on of Occidental’s (OXY) Reeves County assets. It’s now running a tighter ship operationally, with improved capital efficiency even in the gassier Delaware acreage. At ~$50/bbl breakeven, PR looks reasonably well-positioned to weather any further oil price declines.

Key Takeaways

Scale Matters: FANG’s sub-$50/bbl breakeven showcases the value of scale, efficient operations, and high-quality acreage. With nearly 900 Mboepd of production and diversified basin exposure, it’s positioned to weather prolonged commodity softness better than smaller peers.

MTDR's Midstream Hedge Helps, But Isn’t Enough: San Mateo gives MTDR a pricing cushion on gas, helping bring oil breakevens down below the $65/bbl threshold. But it’s still barely free cash positive at $65 WTI, underscoring the limits of integration without size.

PR is the Middle Ground: With breakevens in the high $40s to low $50s, PR reflects the upside of disciplined M&A. Its post-OXY and Earthstone footprint delivers enough scale to generate free cash flow at current prices, but not enough to separate it from the pack.

$2/mcf Gas Doesn’t Tell the Full Story, But Still Useful: While a flat gas price assumption oversimplifies basin-specific dynamics, it still illuminates relative operating leverage. It shows that MTDR is much more reliant on midstream upside, whereas FANG and PR can run lean and profitable regardless.

Current WTI ($65/bbl) Is a Tight Squeeze: The breakeven charts suggest US E&Ps are far from dead—but the margin of safety is getting thinner. If prices slip below $60/bbl, MTDR turns negative and PR starts to wobble. Only FANG remains comfortably above water.

In short, I don’t believe we are in the dead zone yet—but it’s getting darker around the edges. Investors should continue to favor scale, basin quality, and operational leverage in the Permian.

1Q25 US E&P Conference Calls

Companies Mentioned

Matador Resources Company (MTDR)

Diamondback Energy, Inc. (FANG)

Permian Resources Corporation (PR)

Occidental Petroleum Corporation (OXY)

Disclaimer: All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time of publishing. However, in view of the natural scope for human and/or mechanical error, either at source or during production, Patrick Enwright accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of the publication. All information is provided without warranty, and Patrick Enwright makes no representation of warranty of any kind as to the accuracy or completeness of any information hereto contained.