Recent Notes

New to the newsletter? Check out the archive (here) to review prior rig count and research notes.

My Friday evening kicked off like most do - sitting at a hockey rink, watching a U11 youth hockey practice while bouncing my attention between my son’s stickhandling drills, observing the arena’s hockey banners from the mid-90’s, and checking my Twitter feed to see who’s moral outrage is currently trending. That all changed though with President Trump’s evening announcement that the US will impose a 10% tariff on Canadian oil and gas imports beginning February 18th. I read that announcement, read a few more articles, and I did what most fathers with five boys in youth hockey would do…I opened my laptop and started running tariff scenarios in my Canadian model.

MODELLING TARIFFS

Leading up to Friday’s announcement, much of the media debate surrounded who would incur the cost of the tariffs - upstream producers, refiners, or the end consumer. And before jumping into the modeling method, yes, tariffs are not directly imposed on Canadians, but rather American businesses pay the tariff to the US government when Canadian imports are purchased. However, my view is that the tariff will likely be borne by Canadian producers through oil and gas price differentials due to the lack of accessibility to alternative markets beyond America. In turn, bargaining power is controlled by the US refiners and my assumption is that the tariff paid by refiners would be entirely offset through a price differential that is further discounted. In terms of where that price differential will land, one of Canada’s more prominent energy analysts has suggested the tariff could equate to a $16-17/bbl price differential on Western Canadian Select (link); my own analysis suggests differentials could widen even further, reaching beyond $18/bbl.

With that rationale in mind, here are my 2025 tariff assumptions for Canada’s exported oil and natural gas production:

Assumption Segments | Crude Oil, Bitumen | Natural Gas |

|---|---|---|

Production Split | 80% Heavy Oil (Oil Sands) 20% Light Oil | 100% Natural Gas |

Exported FY25 Avg. Daily Production Estimate | 3.4Mbpd Heavy Oil 0.8Mbpd Light Oil | 8.7Bcfpd |

Export Pricing Estimate | CAD $85/bbl, Heavy Oil CAD $92/bbl, Light Oil | CAD $2.99/Mmbtu |

Export Revenues, FY25 | CAD ~$122B | CAD ~$10B |

Trump Tariff, 10% Revenue (2/18/25 - 12/31/25) | CAD ~$11.3B | CAD ~$0.9B |

PRODUCTION

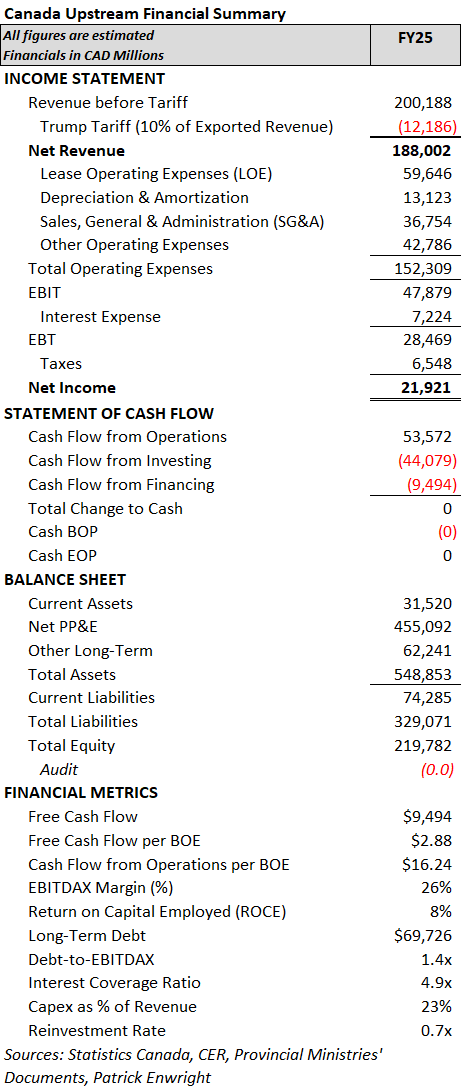

The significance of Canada’s oil and gas exports cannot be understated. Over 80% of Canada’s oil, bitumen and liquids production, and over 45% of Canada’s natural gas production is exported. With an estimated 3.5% YoY production growth, equating to over 9.0MMboepd in total daily production, FY25 daily export volumes equate to an estimated 5.7Mboepd, or 63% of Canadian oil-equivalent production. Should President Trump’s 10% tariff, beginning February 18, extend for all of 2025 the associated cost of the tariff equates to approximately CAD $12.2B.

FINANCIAL IMPLICATIONS OF THE TRUMP TARIFF

Drawing from my assumption that the Trump tariff will likely be borne by Canadian producers through a widening price differential, my estimates suggest that the tariff equates to an additional CAD ~$5.85/bbl on top of an estimated discount of CAD $12.50/bbl for Western Canadian Select (WCS) relative to the WTI benchmark. More simply, a WCS spot price of CAD $84/bbl equates to a realized price of CAD $65/bbl, a -22% discount.

The implications of the tariff will likely impact Canadian producers in a multitude of ways. From an operating standpoint, expect to see cost initiatives deployed in the coming months with an emphasis on lease operations and transportation subcontracts, as well as a tightening of corporate overhead (SG&A) costs in the range of -4% to -10%. For oilfield services firms, manufacturers and distributors, these cost initiatives would likely translate into contract reviews and demands for cost reductions in order to realign to evolving market conditions.

Despite Canadian producers’ best efforts to mitigate widening price differentials through cost initiatives, the impact of the Trump tariff will be most apparent when evaluating cash flow. Given the capital intensiveness of the industry and the related cyclical cash flows, Cash Flow from Operations (CFFO) and Free Cash Flow (FCF) are critical barometers for determining capital programs, debt servicing obligations and generating shareholder value through dividends and share buybacks. The historical trend suggests estimated national-level CFFO on a per BOE basis to be ~$18/BOE in FY23, and ~$22/BOE in FY24. For FY25, should the tariff extend through to the end of the year, CFFO per BOE could average ~$16/BOE, effectively a -25% reduction on an estimated YoY basis. For FCF, the impact could be even more profound. But before jumping into the impact of FCF and the likely adjustments to capital allocation strategies, lets first review my national-level capital spend expectations for 2025.

2025 CAPITAL EXPENDITURES

My FY25 national-level capital spend (Capex) is estimated at ~$44B, a -5% reduction from last year’s ~$46.6B Capex estimate. The $44B spend guide includes estimates of $13B in Oil Sands Capex, $27B in D&C Capex and $3.5B in land and infrastructure-related (non-D&C) Capex. Operationally, the YoY reduction in capital spend translates to average rig count declining by as much as -10%, from an average annual rig count of 188 rigs in 2023 to 170 rigs estimated for 2025. Though this projection corresponds to lower commodity prices, it also accounts for operational improvements such as improved cycle times. Similarly with frac crews, YoY completion times are forecasted to improve due to greater utilization of Simulfrac and Trimulfrac capabilities, resulting in 5,345 wells brought online, a 1% YoY increase.

At a provincial level, Alberta will continue to dominate upstream Capex with $30.9B estimated between Oil Sands and conventional oil and gas development. For British Columbia, the upcoming operational start of LNG Canada corresponds to a ramp in D&C activity, coupled with further infrastructure-related development in northeast BC. As a result, BC’s Capex is project to reach $8.1B for this year. Rounding out the onshore capital spend, Saskatchewan is expected to realize $2.0B in Capex, and $0.6B is estimated for southwestern Manitoba. Lastly, Atlantic Canada’s offshore development is forecasted to eclipse $2B for FY25.

Cut Through Noise with The Flyover!

The Flyover offers a refreshing alternative to traditional news.

We deliver quick-to-read, informative content across sports, business, tech, science, and more that cuts through the noise of mainstream media.

The Flyover's talented team of editors meticulously collects the day's most important news, ensuring you stay informed on top stories and equipped to win your day.

Join over 950,000 savvy readers and leaders who trust The Flyover to provide unbiased insights, sourced from hundreds of outlets!

FREE CASH FLOW & CAPITAL ALLOCATIONS

My 2025 FCF forecast is estimated at ~$9.8B, representing a -59% YoY decline. While there is plenty of subjectivity in this estimate and I can appreciate objections to my modeling methodology, my rationale is this: on an oil-equivalent basis, commodity prices are forecasted to decline YoY; factor in the Trump tariff that is projected to cost Canada’s upstream sector ~$12.2B and an annual Capex budget that is -5% less than last year’s, but nonetheless still $44B, and you arrive at a materially deficient free cash position relative to recent year’s past. As I mentioned in Part 1 of my historical market assessment (link), this is a conceptual assessment of what Canada’s aggregated upstream sector would look like operationally and financially, and until Canadian E&Ps announce their response to the Trump tariff we are all sitting by the proverbial water cooler speculating on who’s crystal ball will be more accurate. With that in mind, here is my timeline forecast of likely talking points and considerations involved in the capital allocation priorities for 2025.

4Q24 Earnings Release (February/March): E&Ps will reiterate their concern that the Trump tariff presents to the industry, while also reinforcing the company’s capital discipline, cost efficiencies and sustainability of their dividend and existing capital guidance amid a low price cycle. Sustaining and growth capital will likely be segmented and illustrate the optionality available should the Trump tariff extend into the second half of 2024. The common takeaway is “stay the course” while supporting government officials to swiftly respond to President Trump’s and negotiate an end to the tariff measures.

1Q25 Earnings Release (May): Our first look at the financial effect of Trump’s tariffs with half of the quarterly earnings results impaired by the anticipated widening differential on exported production. E&Ps will highlight cost initiatives that are underway and note the collaborative efforts of OFS, manufacturer and distributor partners to find ways to reduce Opex and Capex. Investors are likely to be reassured that the base dividend remains sustainable with executives and IR teams highlighting their robust hedging programs. Debt obligations of highly levered E&Ps will come under increased scrutiny, and debt covenant compliance potentially becomes a key discussion point. Production guidance remains on track with Capex efficiencies potentially lowering the guidance floor.

2Q25 Earnings Release (August): A full quarter of tariff-impaired financial results have tightened discretionary spend. Talking points emphasize capital discipline, operational cost reductions and the initial series of Oil Sands-related turnarounds will highlight on-time scheduling and Capex coming under budget. Emphasis on shareholder value will reiterate the base dividend, and a select few E&Ps may even highlight their continued allocations towards buyback programs amid compelling stock valuations. A small segment of E&Ps will reiterate their base dividend, though elevated debt issuance will flush out the dividend sustainability of these E&Ps.

3Q25 Earnings Release (November): Should the Trump tariff still be in play at this point in the year, material operational changes are likely to transpire. For some E&Ps, this would equate to a lowering of capital and production guidance, including rig reductions and completion deferrals amid widening price differentials/lower commodity prices. Further debt issuance becomes more widespread in order to fund base dividends, though there is the potential for some E&Ps to finally announce dividend reductions. Fortunately though, many E&Ps have maintained leverage ratios at or near 1.0x, so an influx in aggregated debt issuance would not be as bad as previous low commodity price cycles. Share buyback programs could be seen as a luxury available only to the leanest, most disciplined producers as FCF is allocated strictly to base dividends and debt commitments.

2026 Capital Budgeting (November/December): Again, if the Trump tariff is still active at this point in the year, the planning efforts for 2026 are materially different than what they were for 2025. While the upstream sector and the related OFS, manufacturers and distributors have become collectively leaner, and leveraged technology to further improve productivity the common quarterly theme would likely be “when will the tariff end?” Production guidance would emphasize sustaining capital programs with YoY production growth likely below 3%, and Capex programs, emphasizing capital discipline and reduced D&C-related rates with OFS partners would aggregate to the $43B - $44B range.

Lastly, sprinkled throughout this forecasted sequence of events would be M&A and strategic investment activity. While I am reluctant to offer a guess on which E&Ps are prime for acquisition, or the total number of M&A deals to occur this year, it’s safe to assume that ~$10B - $15B+ in M&A activity could occur in 2025 based on the historical trend during the post-COVID era.

So with that, my 2025 upstream outlook is complete. It still remains unclear for how long, or whether further escalation of tariff measures will take place. Nonetheless, it is apparent that widening price differentials are on the horizon for Canada’s upstream sector, and the implications could correspond to the outlook as outlined above.

As always, should you have any questions, comments or complaints, feel free to connect with me via email at [email protected] or via phone at (403) 991-8587.

Disclaimer: All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time of publishing. However, in view of the natural scope for human and/or mechanical error, either at source or during production, Patrick Enwright accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of the publication. All information is provided without warranty, and Patrick Enwright makes no representation of warranty of any kind as to the accuracy or completeness of any information hereto contained.